Probably, it’s one of the most powerful concept in the world of investments for all investors irrespective of their depth of financial / investment knowledge. It’s critical to understand and imbibe this simple concept very early in one’s life and investment journey. Since it needs to be developed as a habit – a behavioural aspect, the process of investment is termed as “art of investment” instead of “science” and I would go to an extent of classifying it as “Principle of Compounding”.

There are two aspects of Compounding, the first is linked to behavioural / psychological and second is mathematical. As we discuss the concept, I will try to keep it simple and short to retain your attention span.

Savings – a Behavioural Approach to Investment

We all have studied and consciously know the simple equation: Income – Expense = Savings

If you want to reduce the gap between yourself and Bill Gates, start with a frugal lifestyle – it’s easy, simple and you really don’t have to spend too much money to understand it either. I don’t want to suggest that you become a miser but you can use your discretion on things you buy, especially the depreciating assets and expenses you incur on restaurants, clothes, etc. It all adds up. The more you save, the more your bank balance will grow. Now, if you develop this habit from your early days of earnings, you will save it for a longer period of time. For example, if you set aside a saving of Rs. 10,000 per year (at the start of the year) from the age of 25 while your friend starts to save from the age of 35. Let’s understand this with a simple example:

- Saving Rs. 10,000 per year from the age of 25 up to age of 55 (an early retirement age):

Rs. 10,000 per year will grow to an amount of Rs. 300,000 by the age of 55 (30 years of savings), i.e. Rs. 10,000 per year x 30 years

- To generate the same amount of corpus (Rs. 300,000) by the age 55, if your friend starts to save from the age of 35, he / she would have to save Rs. 15,00 per year, i.e. Rs. 300,000 ÷ by 20 years

- An increase of 50% in the saving amount to raise the same corpus for a delay of 10 years to commence savings

Imagine the comfort and financial independence it will provide in your life journey. This will reduce the stress to build a retirement corpus as you grow old. The idea to postpone the savings and hoping that you will catch-up with higher income or win a lottery has little merit. You will be able to appreciate this, if you can put the above example on piece of paper and do basic calculation, with your own current economic circumstances. Even without accounting for interest (which we will review in the article a little later) the impact of saving by additional one year is significant and it compounds with every single year. Apply the above example to a realistic saving amount and your age profile and then compare the difference in percentage terms. The above example by way of Rs. 10,000 per year can be multiplied by any factor to reflect your economic class. The degree of impact (/ percentage) will be same irrespective of the amount saved – the point being that it’s the passage of time which is of critical importance.

If you haven’t started saving periodically or systematically and if you have passed the age of 25, you can start it now!!! A lifestyle, is a choice one makes – so decide yourself.

May be it’s time to start to look at the equation a little differently: Income – Savings = Expense This is the quantity aspect of “Savings”and first dimension of “Compounding”. Start compounding your savings as early as possible for a better future and bigger pot of wealth.

Channelizing Savings into Investments

What you do with Savings is the second important part of Compounding. It’s not a pecking order of importance, but consider it as a second variable which can not only grow your savings but also accelerate the growth of your savings, depending upon your risk.

According to me, apart from unforeseen circumstances (or luck), risk is a factor of awareness / knowledge. The more you are unaware, the more is the likelihood of perceiving a thing / product / situation as “risk”. It is highly recommended that you keep yourself abreast of the developments in financial products and global affairs in general, financial world in particular.

Whether to undertake an investment decision or not can be an informed decision after weighing the risks associated with it. You need not have studied finance or mathematics, most of these things are pretty simple and easy to understand, just develop the habit.

You have range of options to deploy your hard earned savings into various investment opportunities via financial instruments.

The choice of financial instrument will decide the growth acceleration of your savings. The choice should be made based on your understanding of the financial product. Whatever be the marketing pitch, always remember – higher the returns, higher the (underlying unforeseen) risk. This equation cannot be altered under any circumstances.

The choice of investment options can start from deploying savings into (risk-free) bank account to a more complicated financial instruments like bonds, equities, derivatives, etc. Never ever invest into a financial product which you don’t understand. It’s nothing but short of gambling. If you don’t understand, please don’t hesitate to consult a financial advisor (or two). If you want to gamble then there are better sports which will give you more thrill and better odds. Savings and Investments are not meant for gambling, as a principle it’s essential to develop right investment habits.

While I intend to cover each financial instruments in greater detail in my forthcoming articles, but what is more important to note is two-step chain reaction process: (i) returns on your investments will help to grow your initial savings; and (ii) the returns on investments will apply further on the increased savings if you don’t withdraw. It will become a powerful cycle, where money will start working for you even when you are sleeping – it’s called Compounding. This is a simple secret which helps rich gets richer and more importantly it will help you to beat inflation. The choice of financial instruments will decide how fast your savings will compound. If you start saving and investing early, you will realize the magnitude of “Power of Compounding”. Now, you can re-work the above calculation of saving, investing and rate of return between age 25 and 35. The difference between two numbers is called as “Compounding Effect”. Let’s understand this with a simple example:

- Invest your saving of Rs. 10,000 per year (at the start of the year 1) from the age of 25 into an instrument which will generate a return of 10% p.a. for 30 years:

(a) Rs. 10,000 will grow to an amount of Rs. 11,000 at the end of year 1 (Rs. 10,000 principal invested and Rs. 1,000 interest earned);

(b) At the start of year 2, an additional principal amount of Rs. 10,000 will be added along with Rs. 11,000 and invested again. This cycle will continue up to 30 times and you will receive the total invested amount at 55 years of age;

(c) The investment will grow up to about Rs. 1,810,000 when you reach 55 years of age

- The above amount of Rs. 1,810,000 can be looked by your friend in two ways:

(a) If your friend invests Rs. 10,000 per year (at the start of the year) from the age of 35 into an instrument which will generate a return of 10% p.a. for 20 years. The corpus amount at 55 years of age will be Rs. 630,000, just about 35% of your corpus;

(b) Alternatively, your friend will have to invest an amount of about Rs. 28,800 p.a. for 20 years to generate a corpus of Rs. 1,810,000, an increase of 2.87 times (about 187% increase) in the saving amount to raise the same corpus

The objective of this article is to not to educate on the exact formula to compute the above computations. The above amounts are rounded off and the objective of the article is to demonstrate the magnitude of power of compounding. You can reach me or your financial advisor for specific guidance on the calculation methodology.

The above calculation demonstrates the power of compounding based on the rate of return (10% p.a. in the above example) on your investment. The early you start investment journey, you will have the ability to make investments into higher return generating instruments (higher risk). It will give you deeper understanding of such products over a longer period of time and continue with them for a longer period with higher allocation of amount. If you start later, the risk appetite will be lower translating into lower rate of return and lower allocation of investment amount.

The discussions sounds very basic and intuitive however if you put it into practise what it does to you subtly is that: (i) it instils a habit in you unconsciously; and (ii) it lay’s a strong foundation for growth and invest into higher return financial instruments gradually without undue risks.

The simple mantra is to develop a systematic way to build wealth and “stay rich”. Hope you had a chance to read my earlier post – “Tribute to Charles Munger”.

This is the quality aspect of “Savings & Investments” and second dimension of “Compounding”. Start compounding your investments with better risk management. Develop your financial independence as early as possible and enjoy the liberation.

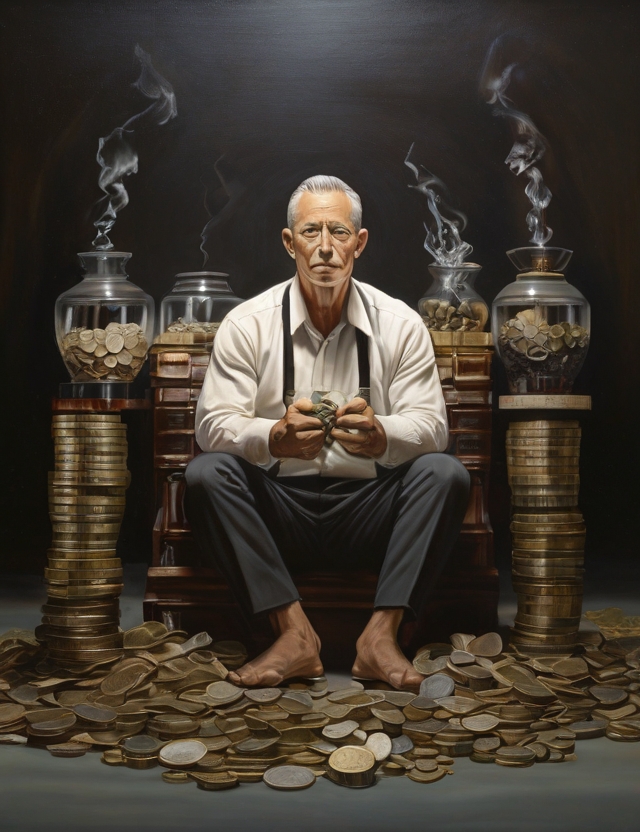

Richness is not what you artificially portray or deceive people to see, it’s what’s in your attitude. More importantly, stay humble and return to the society.

Sukumar Jain, a Mumbai-based finance professional with global experience, is also a passionate traveler, wildlife enthusiast, and an aficionado of Indian culture. Alongside his career, which includes diverse roles in international banking and finance, he's working on a wildlife coffee table book and enjoys sculpture and pottery. His interests span reading non-fiction to engaging in social and global networking.